Standards-Based Risk Intelligence for Cyber Insurance Underwriting

Underwrite cyber insurance and manage portfolio risk with Black Kite.

Trusted by

The Threat Landscape Moves Faster Than Policies. Are You Exposed?

Cyber insurance policies must keep up with today’s ever-changing cyber threat landscape, and manual, point-in-time risk assessments simply aren't enough. The sheer velocity and sophistication of attacks mean traditional methods leave gaping holes in coverage and expose carriers to unforeseen liabilities.

Whether it's accurately assessing an applicant's true cyber hygiene or conducting a real-time, aggregated cyber risk assessment across your entire portfolio, the challenge is clear: you need a solution that evolves as rapidly as the threats themselves.

Black Kite offers insurance carriers an AI-driven risk analysis solution designed to grow alongside your investment portfolios, turning uncertainty into informed action.

Third-Party Breaches Are Reshaping Insurance Risk

The finance and insurance sector ranked as the second most impacted industry by third-party data breaches last year, accounting for 14.9% of all such incidents. Of the insurance carriers that experienced a breach, only 42.8% measurably improved their cyber hygiene afterward. This means a majority are leaving themselves—and their clients—exposed to repeat incidents.

The 2025 Third-Party Breach Report outlines actionable strategies and highlights how proactive measures, intelligence-driven tools, and stronger vendor collaboration can empower your organization to mitigate risks, strengthen resilience, and secure your operations against emerging threats.

Underwriting Confidence in an Uncertain World

Here's how Black Kite empowers insurance carriers to navigate complex cyber risks and protect their portfolios.

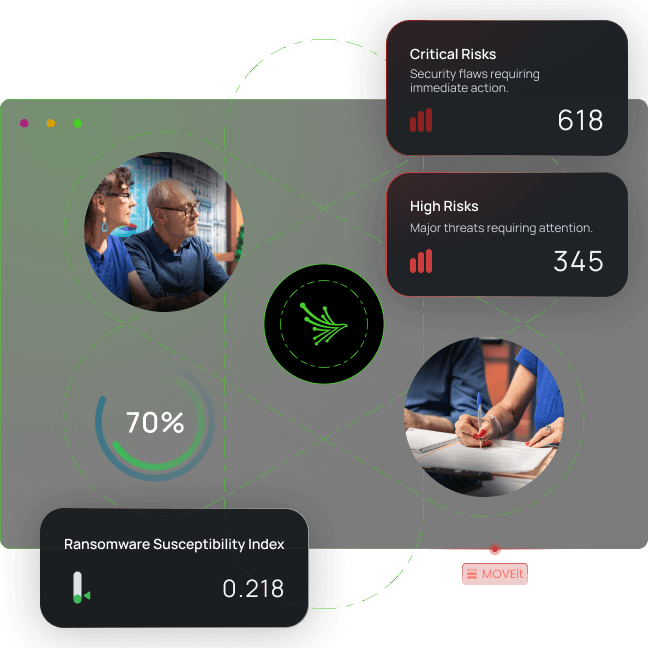

Anticipate Ransomware Attacks with Predictive Intelligence

The cyber threat landscape is constantly shifting, demanding dynamic solutions. Our AI-powered platform provides unparalleled ransomware predictability with the Ransomware Susceptibility Index® (RSI™), the world’s first and only ransomware indication tool.

This proactive intelligence allows you to go beyond traditional risk assessments, providing unique insights into vendor and applicant susceptibility to ransomware, thereby helping you meet the ever-evolving demands for comprehensive cyber insurance coverage.

Learn more about Ransomware Susceptibility Index® (RSI™).

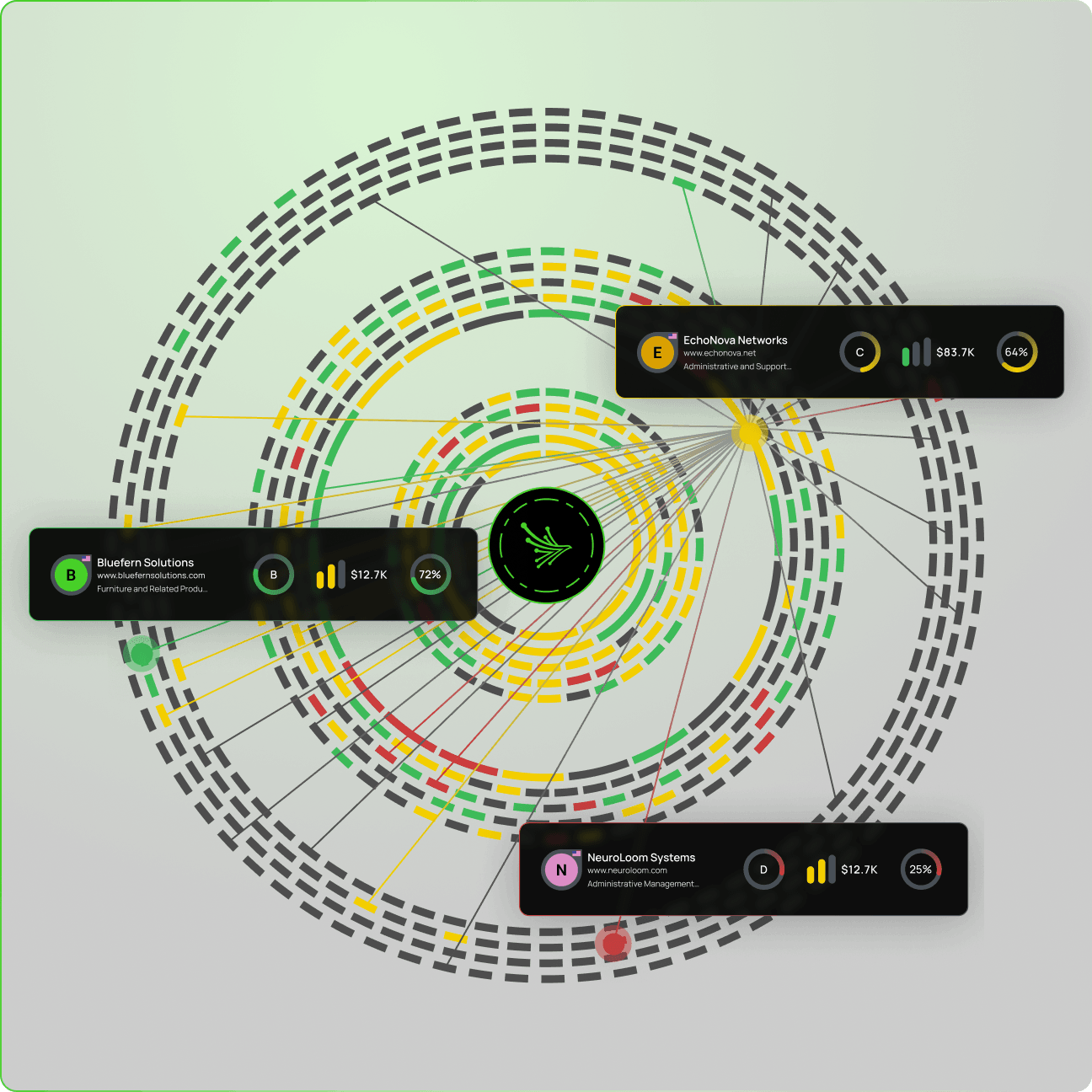

Achieve Continuous, Multidimensional Risk Visibility

Every second counts when it comes to portfolio management and preemptively identifying systemic risk. Using only one domain, Black Kite offers a multidimensional view of any entity’s attack surface 24/7/365.

This continuous visibility allows you to gain unparalleled insight into the hidden cyber risks across your vast insurance partner ecosystem, empowering you to:

- Gain visibility with Nth-party identification & inventory to expose every corner of your ecosystem.

- Proactively respond to Nth-party breaches by identifying impacted 4th parties in real-time.

- Proactively respond to geopolitical strife & natural disasters affecting your supply chain.

Learn more about Nth-Party Visibility and Geopolitical Monitoring.

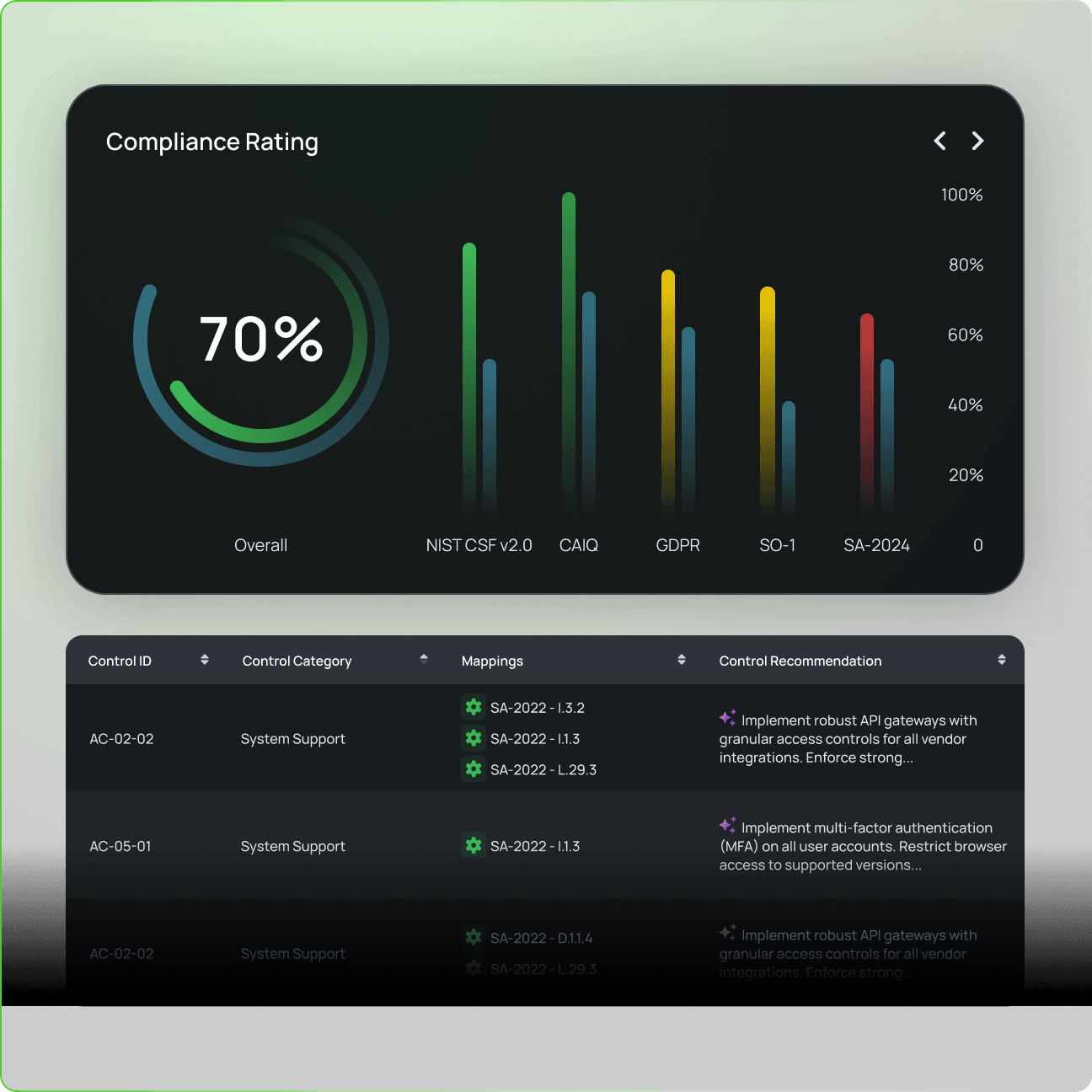

Automate Assessments to Avoid Broker Back-and-Forth

Overcome the manual burden and maximize production levels by automating third-party risk assessments. Black Kite's automated scoring and strategy reports take on the brunt work of assessing numerous vendor relationships.

This directly impacts your ability to avoid the time-consuming back and forth between applicants and brokers, ensuring your team's focus remains on critical vulnerabilities, streamlining the process without draining resources or the budget.

Learn more about AI-powered Cyber Assessments and Custom Cyber Assessment Frameworks.

Quantify Risk for Underwriting and Portfolio Exposure

Black Kite leverages Open FAIR™ to measure the quantifiable financial impact of cyberattacks on your firm, its policyholders, or critical third-party service providers. Whether it’s pricing policies or making investment decisions, our benchmarking capabilities and standards-based intelligence transform inconsistency into uniformity.

Cyber risk quantification enables more precise underwriting decisions and comprehensive management of accumulated portfolio cyber risk, helping you maintain an acceptable portfolio loss ratio and ensure diversification.

Learn more about Cyber Risk Quantification.

Insights Insurance Business Leaders Understand

Protect Your Insurance Organization from Third-Party Risk

Learn how Black Kite can help you quantify and maintain visibility of your cyber risk exposure.