Identifying Cyber Risk for Financial Institutions

High liability. Increasing regulations & exposure. Limited resources. Let Black Kite provide the quality data you need.

Trusted by

Financial Services' Greatest Risk Lies Outside Its Walls

The financial services sector is a vault for the world's most sensitive data, from bank accounts and credit card numbers to social security information, that is seemingly protected by stringent regulations and robust internal defenses. However, this perceived safety creates a dangerous blind spot.

The true, and often overlooked, vulnerability lies within the extensive network of third-party vendors that serve the financial industry. As global regulations continue to intensify, financial institutions face increasing liability from these hidden dangers. Securing the financial supply chain and meeting escalating demands requires AI-driven data and a vast digital footprint to expose critical risks.

Financial Services Vendors Are the New Frontline

Direct ransomware attacks on Financial Services companies dropped by 27% between 2023 and 2024. But this perceived calm masks a storm brewing in your vendor ecosystem. A staggering 92% of vendors serving the financial industry received a C, D, or F score in Information Disclosure, a critical weakness that hands cyber criminals the blueprint to your sensitive data.

Uncover the full scope of financial cyber risk in our latest report. Learn how to proactively manage the threats lurking in your vendor ecosystem and fortify your defenses.

Protect Your Reputation and Your Bottom Line from Hidden Vendor Risks

The true vulnerability lies in vendor risks. We help you expose them. Here's how Black Kite can help you monitor your supply chain cyber risks.

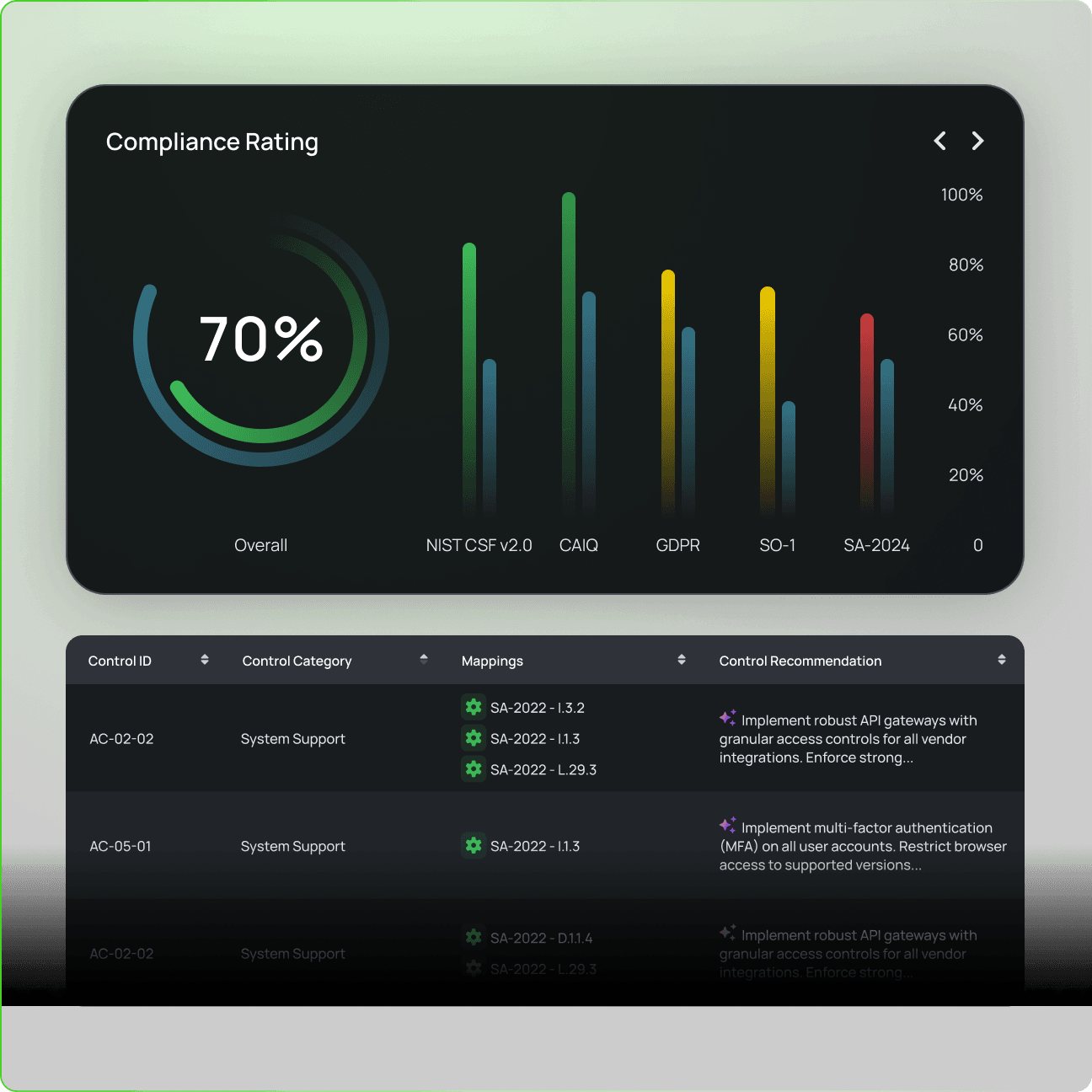

Cross-Reference Compliance Against Evolving Financial Regulations

Our platform provides unparalleled correlation of cyber risk findings against a broad spectrum of stringent financial industry regulations and standards, including PCI-DSS, NYDFS, GDPR, DORA, and CCPA.

This dynamic cross-referencing automatically assesses vendor compliance levels, significantly reducing manual effort for both your team and your third parties, ensuring continuous adherence to the complex and evolving global regulatory landscape that governs sensitive financial data.

Learn more about AI-powered Cyber Assessments and Custom Cyber Assessment Frameworks.

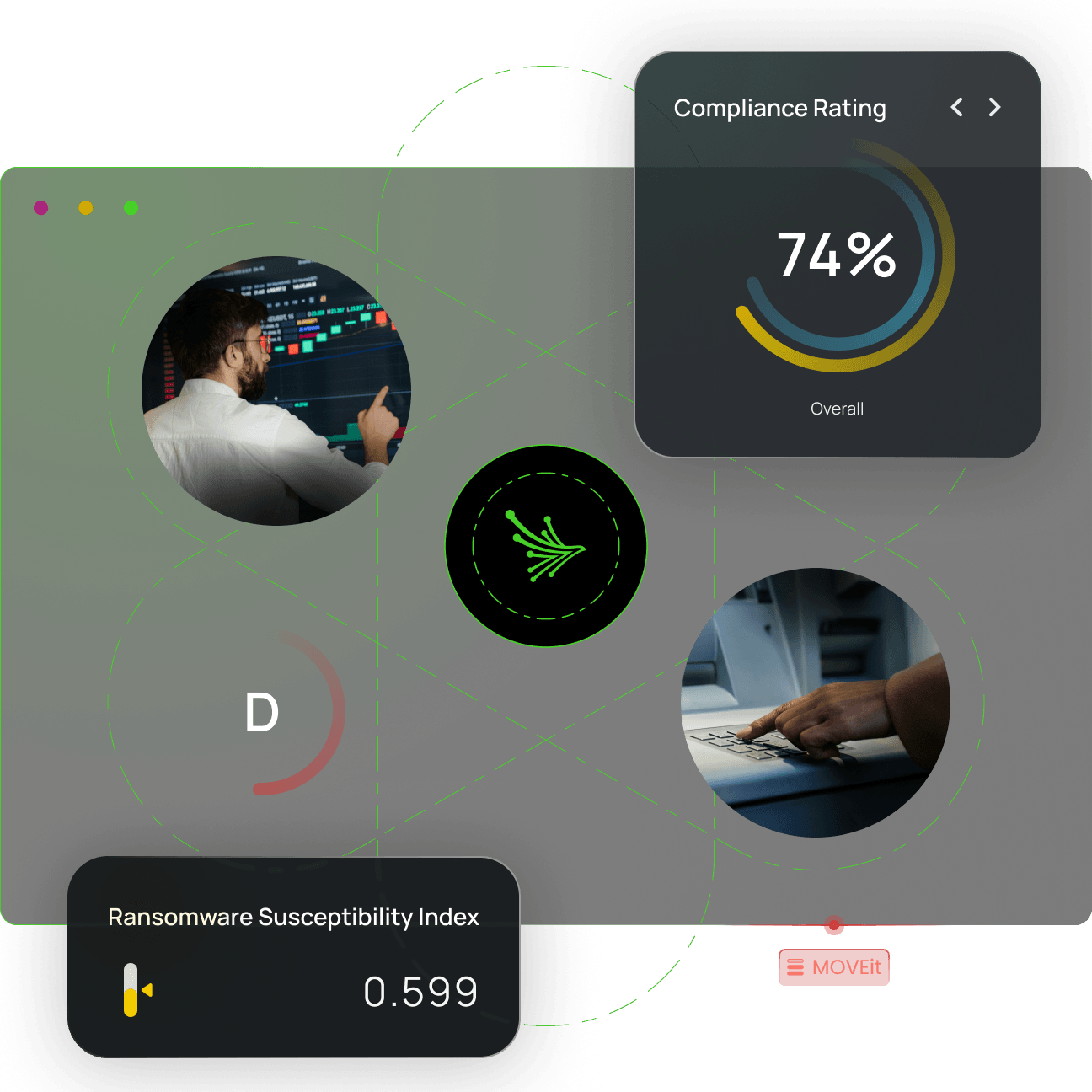

See Where Ransomware Is Likely to Strike

While direct attacks on the financial sector are trending down, risk from the vendor ecosystem is growing. Our AI-powered platform provides unparalleled ransomware predictability with the Ransomware Susceptibility Index® (RSI™).

This enables you to anticipate attacks before they strike, as companies with a critical RSI are 96 times more likely to experience a ransomware attack than those with low scores. This high-quality intelligence helps reduce the uncertainty around your cyber risk and fortifies your supply chain against this critical threat.

Learn more about Ransomware Susceptibility Index® (RSI™).

Reveal Hidden Exposures Deep Within Your Digital Ecosystem

Transform your third-party risk management from reactive to predictive with additional manual work. Black Kite automates the continuous identification of security gaps across your vendor network, proactively uncovering previously unrecognized risks within your Nth-party ecosystem. Our comprehensive, scalable intelligence platform enables you to:

- Gain visibility with Nth-party identification & inventory to expose every corner of your ecosystem.

- Proactively respond to Nth-party breaches by identifying impacted 4th parties in real-time.

- Proactively respond to geopolitical strife & natural disasters affecting your supply chain.

Learn more about Nth-Party Visibility and Geopolitical Monitoring.

Quantify Risk for Executives and Boards

Black Kite uses Open FAIR™ to measure the precise financial impact of cyber incidents on your firm, its vendors, and critical third parties.

This capability empowers you to not only establish and maintain an optimal level of loss exposure but also to clearly articulate cyber risk posture to executive leadership and demonstrate meticulous due diligence to financial regulators, aligning security with enterprise-level financial governance.

Learn more about Cyber Risk Quantification.

“TPRM regulatory requirements continue to increase. I like to be ahead of that conversation with Black Kite.”

– Richard Roark, Sr. VP/CTO, Bay Federal Credit Union

When Livelihoods Are on the Line, Financial Services Leaders Trust Black Kite

Protect Your Financial Services Organization from Third-Party Risk

Learn how Black Kite can help you quantify and maintain visibility of your cyber risk exposure.